INNO Accounting services

Vietnam license fee

Main content

Legal grounds

- Law on Tax Administration No. 38/2019/QH14

- Decree 109/2013/ND-CP

- Decree 139/2016/ND-CP

- Decree 126/2020/ND-CP

- Circular 302/2016/TT-BTC

- Circular 65/2020/TT-BTC

What is the license fee?

The license fee is an annual direct tax payable by individuals and businesses based on investment capital/charter capital or revenue.

Who has to pay the license fee?

Subjects to pay license fees include individuals, business households, organizations, and enterprises with business activities.

Cases exempt from paying license fees

Cases that are exempt from paying license fees include:

+ License fee exemption in the first year of establishment in the following cases:

- Newly established company.

- Households and individuals doing business and production activities for the first time.

- During the license fee exemption period, individuals, business households, organizations, and enterprises opening more branches, representative offices, and business locations will be exempted from license fees.

+ Small and medium-sized companies that move from household businesses are exempt from license fees within three years of the first Enterprise Registration Certificates issuance.

+ Individuals, business households, and groups of individuals engaged in production and business activities with an annual turnover of 100 million or less.

+ Individuals and business households that do not do regular business have no fixed business location.

+ Individuals and households doing business in salt production.

+ Organizations, individuals, and households are farming, catching seafood, and providing fishery logistics services.

+ Commune cultural post office, press agency.

+ Cooperatives and unions of cooperatives operating in agriculture according to the provisions of the law on cooperatives paying the profession.

+ People’s credit funds, branches, representative offices, business locations of cooperatives, unions of cooperatives, and private enterprises doing business in mountainous areas.

+ Public general education institutions and public preschool educational institutions.

License fee level

For companies:

Unit: VND/Year

| Charter capital | License fee |

| Company with charter capital or investment capital over 10 billion | 3,000,000 |

| Company with charter capital or investment capital of 10 billion or less | 2,000,000 |

| Branches, representative offices, business locations, non-business units, other economic organizations | 1,000,000 |

For individuals and households engaged in production and trading of goods and services:

Unit: VND/Year

| Revenue | License fee |

| Revenue over 500 million | 1,000,000 |

| Revenue over 300 million to 500 million | 500,000 |

| Revenue over 100 million to 300 million | 300,000 |

| Revenue less than 100 million | Exempt |

License fee declaration

Deadline for submission

The deadline for submitting the license fee declaration is January 30 of each year for newly established enterprises or establishing additional dependent units.

Note: The license fee declaration is only submitted once from the business establishment. In the following years only have to re-submit it if there is a change.

Where to submit declaration: submit the license fee declaration for the Tax Office directly managed through the electronic tax account at the website thuedientu.gdt.gov.vn.

Cases in which the license fee declaration must be re-submit

| Case | Deadline | Submit at |

| Change the charter capital or investment capital (Regardless of the increase/decrease of charter capital effect or not the level of license fee) | Deadline is 30th January of the following year. For example: Company A registered charter capital 200 million. In 10th June, 2023 company increase the register charter capital to 400 million. So deadline for re-submit license fee is 30th January, 2024. | Tax Office that directly manage company |

| Open branches, representative offices, business locations in the same province as the company | The deadline for submission is January 30 of the year following the year of establishment. | The Tax Office that directly manage company |

| Open branches, representative offices, business locations other than the province with the company. | The Tax Office that directly manages that branch, representative office or business location. |

Deadline for payment of license fees

The deadline for paying the license fee is January 30th of each year.

Penalty for late declaration and paymentof license fee

Late declaration

| Penalty level | Case |

| Warning | Late declaration for the first time |

| 500,000 – 1,000,000 | Declare late from the 2nd time onwards |

| 1,000,000 – 3,000,000 | Incorrect, Incomplete declaration |

| 3,000,000 – 5,000,000 | No declaration |

Late payment

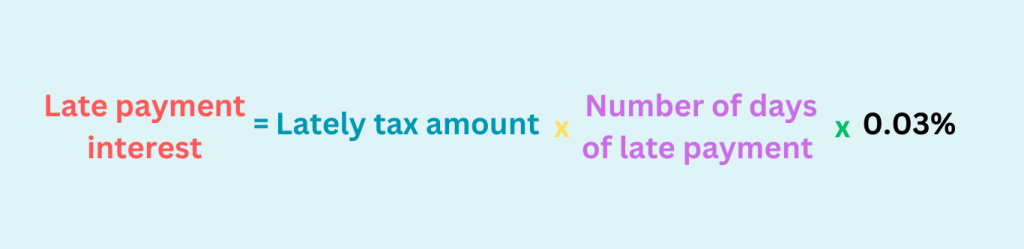

Similar to other fees, taxes, when late payment of license fees, late interest will be calculated at the rate of 0.03 %/day. The interest on late payment of license fees is calculated as follows:

Explore more

Related services

News

Related Posts