INNO Accounting services

Vietnam corporate income tax

Main content

Overview of corporate income tax (CIT)

CIT is a direct tax, levied directly on the income of enterprises engaged in production and trading of goods and services and other types of income as prescribed.

Taxpayers:

CIT payers are organizations engaged in the production and trading of goods and services with taxable incomes as prescribed, including:

Enterprises established under Vietnamese law: enterprises established under Vietnamese law are subject to CIT on global income (including income generated in Vietnam and overseas) CIT in overseas would be claimed as tax credit in Vietnam.

Read more: Deducting CIT already paid abroad

Enterprises established under foreign law (i.e. foreign enterprises) with or without a permanent establishment (PE) in Vietnam have income in Vietnam.

- Enterprise have a PE in Vietnam: Subject to CIT based on their Vietnam sourced income and in comes sourced from overseas relating to the operation of PE in Vietnam.

- Enterprise don’t have a PE in Vietnam: Subject to CIT based on their Vietnam sourced income, where applicable, under the Foreign Contractor Tax (FCT) regime.

A permanent establishment (PE) is a fixed place of business through which an enterprise carries on all or part of its business. Including: Company headquarters, branches, representative offices, factories, building site, workshops, agent, etc.

Vietnam CIT rate

Currently, there are 2 tax rates applied to calculate CIT for enterprises established under Vietnamese law:

Standard CIT rate is 20%: Applicable to all businesses (except for some businesses with tax rates of 32% to 50% or businesses subject to preferential tax).

Tax rate from 32% to 50%: Applied to activities of prospecting, exploration and exploitation of oil, gas and other rare and precious resources.

- Tax rate of 40%: Applied to rare and precious resource mines with 70% of the assigned area or more in areas with extremely difficult socio-economic conditions on the List of areas eligible for investment incentives.

- Tax rate of 50%: Applied to the search, exploration and exploitation of precious and rare natural resources such as platinum, gold, silver, tin, tungsten, antimony, precious stones, rare earth except petroleum.

For enterprises established under foreign law, the foreign contractor tax regime will be applied. The tax rate depends on the type of business.

Tax period

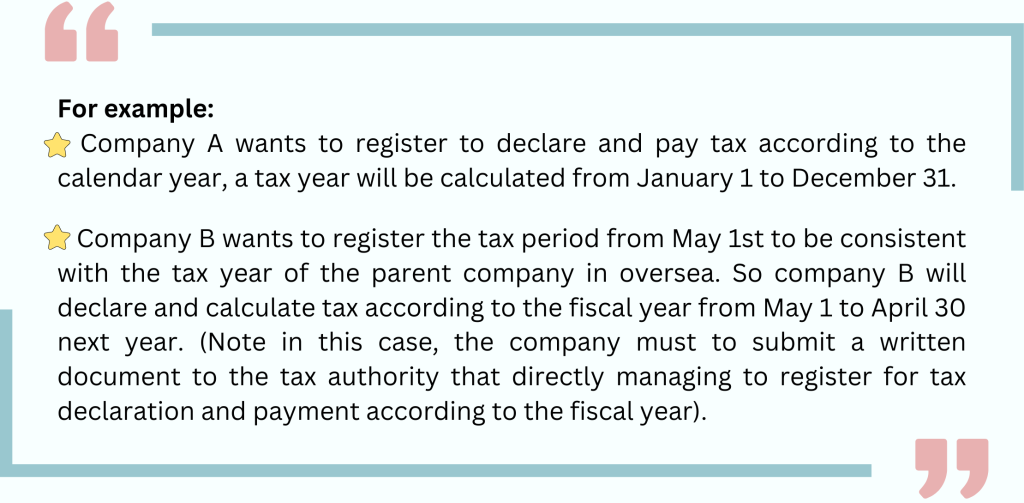

- The enterprise’s tax period is determined according to the calendar year, if the enterprise applies a fiscal year different from the calendar year, the tax period is determined according to the fiscal year.

Important note: Quarterly, based on quarterly operating business results, enterprises pay (if any) CIT temporarily calculated into the State budget at least 80% of the amount of CIT payable in the quarter (Note that enterprises only have to temporarily calculate and pay tax, do not have to file quarterly returns).

CIT calculation

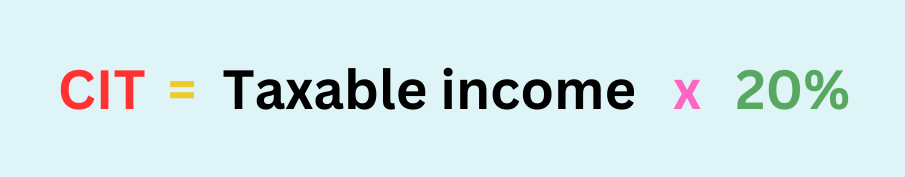

Method of calculating CIT on net profit

Subjects of application: Companies established and applied fully Vietnamese Accounting Standard (VAS)

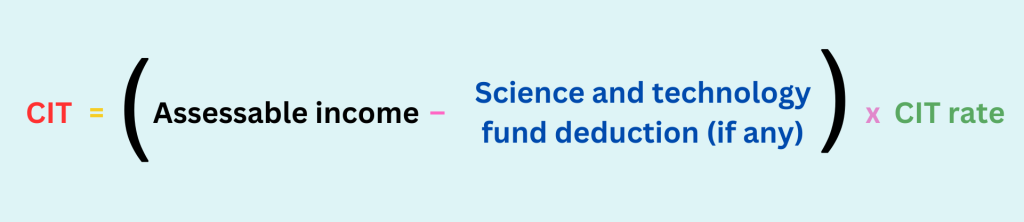

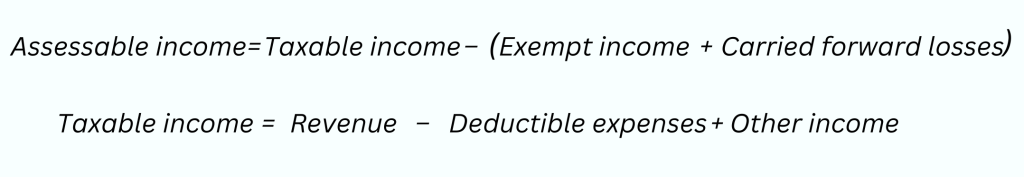

Tax formula:

In there:

Method of calculating direct CIT

Applicable object:

- Enterprises with a turnover of less than VND1 billion ((and not voluntarily registered for tax calculation under the net profit method).

- Household business.

- Foreign organizations and individuals in Vietnam are not under the Law on Investment.

- The business organization not applied fully VAS.

Tax formula:

Tax rates will depend on the type of business. Specifically:

- Service: 5%

- Education, health care, performing arts alone: 2%

- Commodity trading: 1%

- Other activities: 2%

Taxable turnover

- Revenue for calculating CIT of the enterprise paying value added tax (VAT) by the deduction method: is the revenue excluding VAT

- Revenue for calculating CIT of an enterprise paying VAT by the direct value-added method is the revenue including value-added tax.

- For enterprises with business activities that customers pay in advance for many years, the revenue for calculating taxable income is amortized each year.

Deductible expenses

Expenses that are deductible when calculating CIT are expenses that are eligible for deduction when calculating CIT, and non-deductible expenses are expenses that do not meet the conditions for deduction as prescribed by law.

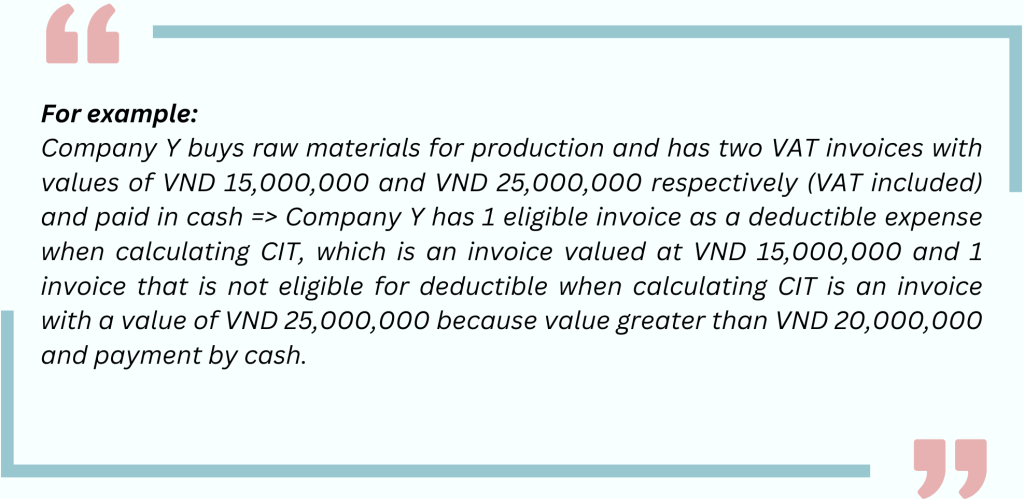

Expenses that are deductible when calculating CIT must simultaneously satisfy the following conditions:

- Actual expenses related to production and business activities of the enterprise.

- Expenses must have all invoices and documents as prescribed.

- Expenses with invoices with a value of over 20 million must be paid without cash.

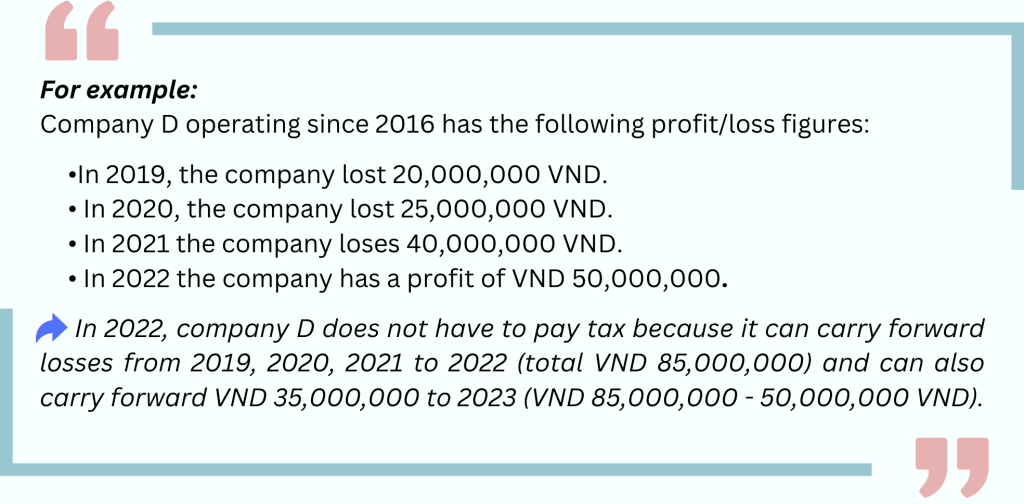

Transfer losses when calculating CIT

- Loss incurred in a tax period when expenses are greater than revenue, the difference between deductible expenses and revenue is the business’s loss carried forward to the following year.

- Enterprises with losses may carry forward their losses to the following year. The period of loss transfer shall not exceed 5 years continuously.

- For enterprises that transform, merge, consolidate, divide, separate, dissolve or go bankrupt, the losses incurred by the enterprise before the transformation, merger or consolidation must be tracked. year-on-year expenses are incurred and offset against the enterprise’s income in the same year after the transformation, merger, consolidation or further transfer into the income of subsequent years of the enterprise after the transformation, merger, consolidated to ensure the principle of carrying forward losses continuously for no more than 5 years, from the year following the year when the loss is incurred.

CIT exempt income

What is tax exempt?

Tax exempt income is income that is exempt from CIT in accordance with law not subject to CIT.

Types of income exempt from CIT

Incomes from agriculture, forestry and fishery, include:

- Income from farming, animal husbandry, aquaculture and salt production of the cooperative.

- Incomes of cooperatives operating in the fields of agriculture, forestry, fishery, salt production in areas with difficult or extremely difficult socio-economic conditions.

- Incomes of enterprises from cultivation, husbandry and aquaculture in areas with extremely difficult socio-economic conditions.

- Income from fishing activities.

- Income from performing technical services directly serving agriculture.

Incomes from scientific research and development, technology transfer:

Incomes from the performance of contracts for scientific research and technology development, products under trial production progress, products made from new technologies applied for the first time in Vietnam.

Incomes from technology transfer in the fields of priority transfer to organizations and individuals in areas with extremely difficult socio-economic conditions.

Income from enterprises with special labour force: Income from production and trading of goods and services of enterprises with 30% of the average number of employees in the year disabilities, people after detoxification, people infected HIV/AIDS and have an average number of employees in the year of 20 or more (excluding enterprises operating in the field of finance, real estate business).

Income from the transfer of emission reduction certificates (CERs) of enterprises granted emission reduction certificates.

Income from some special credit activities:

- Income from performance of State-assigned tasks of Vietnam Development Bank in investment and development credit activities, export credit.

- Income from credit activities for the poor and other policy beneficiaries of the Bank for Social Policies.

- Incomes of state financial funds and other state funds operating for non-profit purposes as prescribed by law.

- Income of organizations in which the State owns 100% of charter capital, established by the Government to handle bad debts of Vietnamese credit institutions.

Incomes of organizations operating in the fields of education, training, health care, socialization:

- The undivided income of the establishment performing socialization in the fields of education – training, health care and other socialized fields shall be left to invest in the development of such establishments in accordance with the provisions of specialized laws on the field of education – training, health and other socialization fields.

- Income forming undivided assets of cooperatives established and operating in accordance with the Law on Cooperatives.

- Incomes from vocational training activities exclusively for ethnic minorities, disabled people, children in extremely difficult circumstances, and subjects of social evils.

- Funds received are used for educational, scientific, cultural, artistic, charitable, humanitarian and other social activities in Vietnam.

Dividend income from capital contribution, joint venture or association with domestic enterprises, after paying CIT in accordance with this Law.

CIT from other activities

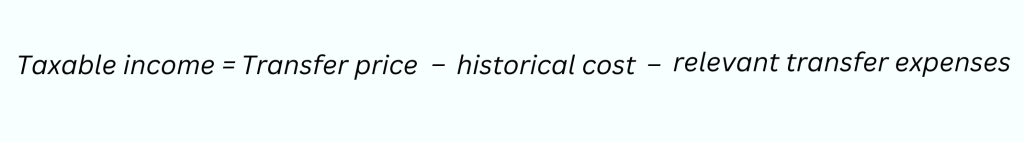

Income from capital transfer

Income from capital transfer of an enterprise is income obtained from part or all of the capital the enterprise has invested in one or more other organizations and individuals

In which:

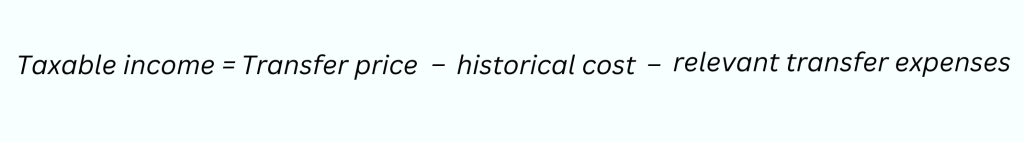

Income from securities transfer

Income from securities transfer means income from the transfer of stocks, bonds, fund certificates and other securities according to regulations

In which:

Income from real estate transfer

Income from real estate transfer includes:

- Incomes from the transfer of land use rights and land lease rights (including the transfer of projects associated with the transfer of land use rights and land lease rights as prescribed by law).

- Incomes from the sub-leasing of land by real estate enterprises in accordance with the law on land, regardless of whether or not there are infrastructures and architectural works attached to the land.

- Incomes from the transfer of houses and construction works attached to land, including assets attached to such houses and constructions, if the value of the property is not separated when transferring, regardless of whether or not there is transfer of land use rights, transfer of land lease rights.

- Income from the transfer of assets attached to land.

- Income from transfer of ownership or right to use housing.

In which:

CIT incentives

CIT incentives are policies that create incentives for production and business enterprises and industries. There are currently 2 types of incentives for businesses:

- CIT exemption/reductions

- CIT preferential rate

Incentives for CIT based on some specific conditions on location, sector, etc

Read more: Vietnam CIT Incentive

Explore more

Related services

News

Related Posts