INNO Accounting services

Overview of Value Added Tax (VAT)

Main content

Overview of VAT

- VAT is a tax applied to goods and services used for production, trading and consumption in Vietnam, except for some goods and services exempt from tax as specified by law.

- VAT is a type of indirect tax (the taxpayer is the consumer (buyer) of goods and services but seller is who declares and pays tax to the state budget).

VAT Tax Rates

According to regulations, there are 4 tax rate levels applied to value-added tax in Vietnam: Exempted, 0%, 5%, and 10%.

+ Exempted tax: Typical goods and services exempted from value-added tax include land use rights transfer, financial services provided by intermediary financial institutions, banks, securities companies, education services, public passenger transport (by bus, train, etc.), technology transfer, software and software services, etc.,

+ 0% tax rate applies to:

- Exported goods and services.

- International transportation.

- Air and sea transportation services provided to foreign companies or via agents.

+ 5% tax rate: This is the tax rate applied to essential goods and services for agriculture, clean water, books, teaching tools, social houses, cultural activities., etc.,

+ 10% tax rate: This is the tax rate applied to other normal goods and services.

=> (A post linked to: More detailed explanation for each tax rate)

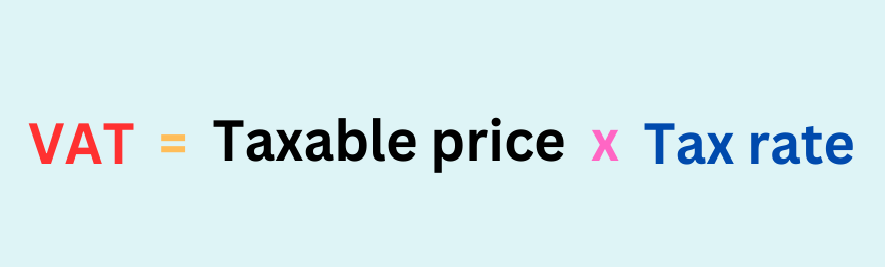

VAT Calculation

In which: The taxable price is the price before (exclusive of) VAT.

For example: INNO purchases a printer for office use at a price of 15,000,000 VND (excluding VAT). Therefore, the taxable price is 15,000,000 VND. The printer is subject to a 10% tax rate, so the value-added tax is: 15,000,000 VND x 10% = 1,500,000 VND.

Methods of tax calculation

There are two methods of VAT calculation: Deduction method and direct method.

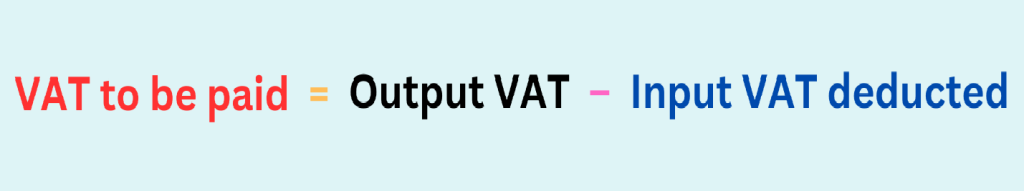

Deduction method

Applicable subject:

- Applicable to companies that operate with full registration of Vietnamese Accounting Standards (VAS), invoices and documents.

- Companies with annual revenue of VND 1 billion or more or annual revenue of less than VND 1 billion but voluntarily register to declare tax using the deduction method.

How to calculate VAT to be paid:

Another post: For more information on VAT calculation, please read the detailed article

Direct method

It includes two methods:

Direct VAT on revenue:

+ Applicable subject: This method applies to:

- Enterprises, cooperatives with annual revenue below one billion dong and not voluntarily registering to apply the deduction method.

- Individuals, business household.

- Company not fully adopt VAS.

+ Calculation formula:

Where in, the VAT rate is regulated as follows:

- Distribution, supply of goods: 1%

- Services, construction without material procurement: 5%

- Production, transportation, services related to goods, construction with material procurement: 3%

- Other business activities: 2%.

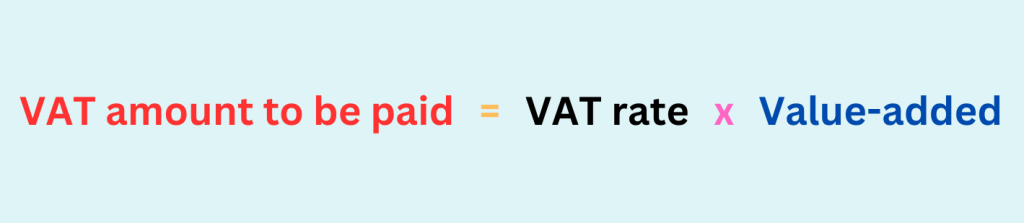

Direct VAT on value-added:

+ Applicable subject

This method applies to subjects that purchase, sell, or engage in gold, silver, and precious stone processing activities.

+ Calculation formula:

Wherein: Value-added = Selling price – The corresponding purchase price (Including VAT)

VAT rate:

- Not subject to VAT: Gold bars, gold pieces, and other forms of gold that are not processed into jewellery or other items.

- 10%: For other activities.

Declaration of VAT

In accordance with the provisions of the VAT regulations, companies are obliged to submit periodic tax reports to the tax authorities responsible for managing their VAT payment obligations

Accordingly, there are two periods of declaring VAT: Monthly and quarterly. Therefore, companies need to determine whether they belong to the group of VAT declaration on a monthly or quarterly basis.

Companies belonging to the group of VAT declaration on a monthly basis:

Companies with total revenue from selling goods and services in the immediately preceding fiscal year of VND 50 billion or more.

Companies belonging to the group of VAT declaration on a quarterly basis:

+ Companies who start business and operation (After 12 months of operation, based on the revenue level of the previous fiscal year to determine whether to declare VAT on a monthly or quarterly basis).

+ Companies with total revenue from selling goods and services of the previous fiscal year fiscal year of less than VND 50 billion.

For example:

INNO was founded in 2018, so in 2018 (the first year of opening), INNO declared value-added tax (VAT) quarterly.

At the beginning of 2019, INNO determined the total revenue in 2018 to be 52 billion VND, and INNO will switch from quarterly VAT declaration to monthly VAT declaration.

At the beginning of 2020, INNO determined the total revenue in 2019 to be 45 billion VND, and INNO will apply quarterly VAT declaration for the year 2020.

Read more: Regulations on deadlines for tax declarations

VAT refund

The subjects eligible for VAT refund include:

Investment projects: There are two cases of investment projects eligible for VAT refund

+ New investment projects: meeting the following conditions:

- Register VAT declaration according to the deduction method and during the investment progress.

- If the investment period is longer than 1 year => Refunded annually.

- Accumulated VAT from VND 300 million upwards => Allowed to be refunded.

+ Enterprises are in operation, declaring VAT according to the deduction method, having a separate new investment project and still under investment period:

- Declare separately for the new investment project and current business activities => Refunded VAT for the new investment project.

- To offset input VAT of the new projects against VAT payable of the currently operating company: If amount after offsetting from VND300 million => Allow to refund.

Export activities:

- Creditable input VAT from VND300 million per monthly/quarterly => Allow to refund.

- If the company has both domestic and export sales => Refunded VAT on inputs serving export activities only. In this case, the enterprise needs to separate the input VAT for each activity, if it cannot be separated, the input VAT will be distributed according to the revenue ratio of the refunded tax period.

Note: The refunded VAT amount does not exceed 10% of export activities’ revenue.

Enterprises that split, merge, dissolve, convert ownership, terminate operations, pay insufficient VAT, or overpay VAT.

=> Refer to more about the conditions for VAT refund, VAT refund procedures (lead the detailed link on VAT refund).

Explore more

Related services

News

Related Posts