INNO Accounting services

Vietnam export tax

Main content

Legal grounds

- Law on Import and Export Tax 2016

- Decree 134/2016/ND-CP

- Decree 08/2015/ND-CP

What is export tax?

Export tax is an indirect tax levied on goods that the State wants to restrict exports.

Export tax purposes:

- Stabilizing prices of some domestic products.

- Ensuring the supply of some domestic products.

- Reducing trade conflicts with other countries.

Goods subject to export tax

According to Article 2 of Decree 134/2016/ND-CP, subjects subject to export tax include:

- Goods exported through Vietnam’s border gates.

- Goods exported from the domestic market to export processing enterprises, export processing zones, tax-suspension warehouses, bonded warehouses, and other non-tariff zones following regulations.

- Goods exported on the spot according to regulations, goods of enterprises exercising the right to export or to distribute.

Goods not subject to export tax

According to Clause 4, Article 2 of the Law on Import Tax and Export Tax, goods not subject to export tax include:

- Goods exported from non-tariff zones to foreign countries.

- Goods are the petroleum part subject to the State’s natural resource tax upon export.

- Goods from one non-tariff zone to another.

- Goods in transit or on loan through Vietnam’s border gates and goods transferred from border gate to border gate according to regulations.

- Humanitarian aid goods, non-refundable aid goods.

Goods of export tax exemption

According to Article 16 of the Law on Import Tax and Export Tax, goods exempt from export tax include:

- Goods exported from foreign organizations and individuals are entitled to privileges and immunities in Vietnam within the norms consistent with international treaties to which Vietnam is a contracting party.

- Goods in the duty-free baggage allowance of people on a country’s exit.

- Moving property and gifts within the norm of foreign individuals, organizations for Vietnamese individuals and organizations, and vice versa.

- Goods traded and exchanged across borders by border residents are on the list of goods and norms serving the production and consumption of border residents. Except for the case of purchasing within the norm but not serving the production and consumption of the border population, goods imported from foreign traders are sold at border markets

- Goods are exempt from export tax under international treaties to which Vietnam is a contracting party.

- Goods with a value or tax payable below the minimum (goods with a value of less than 500,000 VND or less than 50,000 VND in export tax).

- Goods temporarily imported for re-export or temporarily exported for re-import within a certain period.

- Goods are not for commercial purposes in the following cases: sample goods; Photo, film, replacement model for samples; small quantity advertising.

- Projects and shipbuilding establishments on the list of preferential industries and trades, according to the provisions of the law on investment, are exempt from tax.

- Goods for export to protect the environment.

- Goods exported to ensure social security and overcome consequences of natural disasters, disasters, epidemics, and other exceptional cases.

Export tax rate

The export tax rate change depends on the type of goods, the exporting country, international agreements, and treaties to which Vietnam is a member.

Download the latest import and export tariff – Here

How to calculate export tax

There are 3 methods of calculating export tax:

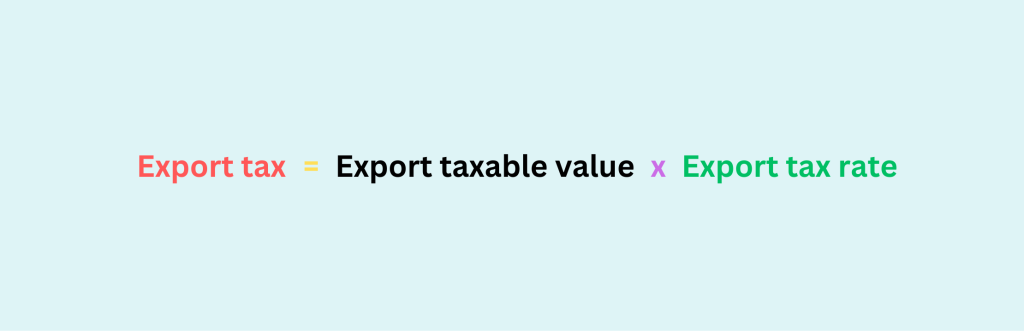

- Percentage method of tax calculation

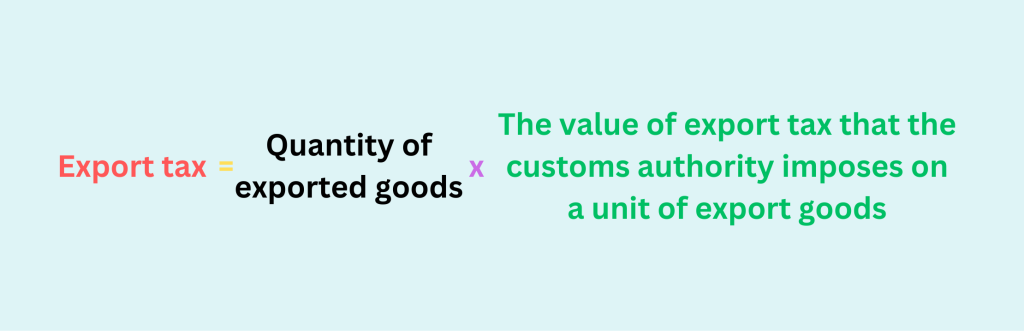

- Absolute tax calculation method

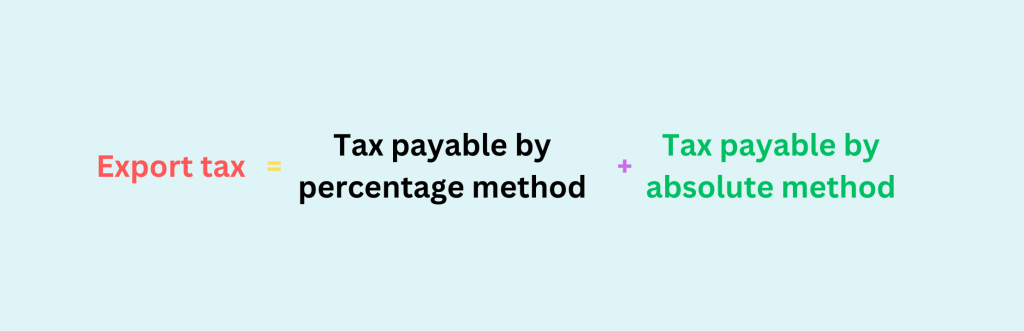

- Mixed tax calculation method

Example

Company A exports 100 items of B at VND 50,000,000, and the export tax rate is 5%. Assume that the customs impose tax rate is 7%.

So the export tax of this item is calculated as follows:

- Apply the Percentage Method:

Export tax = 50,000,000 x 5% = VND 2,500,000

- Apply the Absolute Method:

Export tax = 50,000,000 x 7% = VND 3,500,000

- Apply the Mixed Method:

Export tax: 2,500,000 + 3,500,000 = VND 6,000,000

Exchange rate for calculating export tax

According to Article 21, Clause 3 of Decree 08/2015/ND-CP, the exchange rate for calculating export tax is the exchange rate of foreign currency purchased and transferred by the Head Office of Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank) at the end of the day of the Thursday of the previous week.

Explore more

Related services

News

Related Posts