INNO Accounting services

Vietnam regulations on depreciation fixed assets

Main content

- Legal ground

- What is the depreciation of fixed assets (FAs)

- Why we need to depreciate fixed assets?

- What are the conditions for recognizing an asset as a fixed asset?

- Depreciation framework for fixed assets

- Depreciation methods

- Calculating depreciation of fixed assets

- The method of depreciation of fixed assets required to notify the tax authority?

- It possible to change the depreciation method during the period of use?

- Can depreciate fixed-asset differently from the depreciation time frame of the Ministry of Finance?

- Can an enterprise change the time of depreciation of fixed assets during its operation?

Legal ground

- Circular 45/2013/TT-BTC

What is the depreciation of fixed assets (FAs)

Depreciation of FAs is the systematic assessment and allocation of the historical cost of FAs to production and business expenses due to natural wear and tear or technological progress technology after the FAs’ useful life.

Why we need to depreciate fixed assets?

A purchased FAs is usually used for a long time, so the cost of buying a fixed asset should be allocated over the useful life instead of just being charged to the year of asset purchase.

For example: A company buying a photocopier will use it for many years, so the cost must be allocated over many years instead of being calculated all at once at the time of purchase.

What are the conditions for recognizing an asset as a fixed asset?

A purchased asset is eligible to be recognized as a fixed asset when the following three conditions are satisfied simultaneously:

- Assets purchased to serve the business activities will certainly receive economic benefits from using such in the future.

- Has a useful life of more than one year.

- The historical cost can be determined reliably at more than VND 30 million.

So, how will assets that are not eligible to be recognized as fixed assets?

Assets that do not qualify for recognition of fixed assets will be recognized as prepaid expenses and amortized over multiple operating periods.

Read more: Prepaid expenses

Depreciation framework for fixed assets

TIME FRAME FOR DEPRECIATION OF TYPES OF FIXED ASSETS

(Issued together with Circular No. 45/2013/TT-BTC dated April 25, 2013 of the Ministry of Finance)

| List of groups of fixed assets | Minimum time of depreciation (year) | Maximum time of depreciation (year) |

| Machinery and power equipment | ||

| Power generator | 8 | 15 |

| Generator, hydropower, thermal power, wind power, gas mixture. | 7 | 20 |

| Transformers and electrical equipment | 7 | 15 |

| Other power machinery and equipment | 6 | 15 |

| Other machinery and working equipment | ||

| Machine tool | 7 | 15 |

| Machinery and equipment used in the mining industry | 5 | 15 |

| Tractor | 6 | 15 |

| Máy dùng cho nông, lâm nghiệp Machinery for agriculture and forestry | 6 | 15 |

| Water and fuel pump | 6 | 15 |

| Metallurgical and anti rust and corrosion surface processing equipment | 7 | 15 |

| Specialized equipment for the production of chemicals | 6 | 15 |

| Specialized machinery and equipment for production of building materials, stoneware and glassware | 10 | 20 |

| Specialized equipment for the production of components and electronics, optics, precision mechanics | 5 | 15 |

| Machinery and equipment used in the leather industry, stationery cultural product printing | 7 | 15 |

| Machinery and equipment used in the textile | 10 | 15 |

| Machinery and equipment used in the garment industry | 5 | 10 |

| Machinery and equipment used in the paper industry | 5 | 15 |

| Machinery and equipment of food producing and processing | 7 | 15 |

| Cinema and health machinery and equipment | 6 | 15 |

| Machinery, equipment of telecommunications, information, electronics, computer and television | 3 | 15 |

| Pharmaceutical manufacturing machinery and equipment | 6 | 10 |

| Other machinery and equipment | 5 | 12 |

| Machinery and equipment used in the petrochemical industry | 10 | 20 |

| Machinery and equipment used in oil and gas exploration and extraction | 7 | 10 |

| Construction machinery and equipment | 8 | 15 |

| Crane | 10 | 20 |

| Experimental and measuring tools | ||

| Experimental and measuring equipment of mechanical, thermal and acoustic quantitives | 5 | 10 |

| Optical and spectral equipment | 6 | 10 |

| Electrical and electronic equipment | 5 | 10 |

| Physico-chemical measuring and analyzing equipment | 6 | 10 |

| Radiation equipment and instruments | 6 | 10 |

| Particularly specialized equipment | 5 | 10 |

| Other experimental and measuring equipment | 6 | 10 |

| Molds used in the foundry industry | 2 | 5 |

| Equipment and vehicles | ||

| Roadway transport vehicles | 6 | 10 |

| Railway transport vehicles | 7 | 15 |

| Water way transport vehicles | 7 | 15 |

| Airway transport vehicles | 8 | 20 |

| Pipeline transportation equipment | 10 | 30 |

| Goods loading and unloading and lifting equipment. | 6 | 10 |

| Other equipment and vehicles | 6 | 10 |

| Management tools | ||

| Calculating and measuring equipment | 5 | 8 |

| Machinery, communications–electronics equipment, and computer software for management | 3 | 8 |

| Other management tools and means | 5 | 10 |

| Housing and structures | ||

| Solid housing | 25 | 50 |

| Mid-shift rest house, shift, mid-shit canteen, dressing house, toilet, garage, etc | 6 | 25 |

| Other housing | 6 | 25 |

| Warehouses, storage tanks, bridges, roads, airfield, parking, drying yeard | 5 | 20 |

| Embankments, dams, culverts, channels, ditches | 6 | 30 |

| Harbor, dock slipway | 10 | 40 |

| Other structures | 5 | 10 |

| Animals and perennial orchard | ||

| Kinds of animal | 4 | 15 |

| Industrial crop plantation, orchards and perennial orchards | 6 | 40 |

| Lawn and green carpet | 2 | 8 |

| Other types of intangible fixed assets not specified in the above groups | 4 | 25 |

| Other intangible fixed assets | 2 | 20 |

Depreciation methods

Currently, there are three methods of calculating depreciation including:

• Straight-line depreciation method.

• Adjusted reducing balance method.

• Method of depreciation based on volume.

INNO guide to choose the suitable method:

| Straight-line depreciation method | Adjusted reducing balance method | Method of depreciation based on volume |

| This method is suitable for companies that use common types of fixed assets (except those mentioned in the other two methods). => Most businesses will choose this method because the calculation is simple, suitable for the characteristics and many types of businesses. | This method is suitable for science and technology companies or companies in the field of technology must change and develop rapidly. Enterprises in this field, machinery and equipment will be easily obsolete, so they need to be depreciated faster than other types of businesses. | This method is suitable for manufacturing companies. This method applies to machines and equipment that satisfy the following conditions simultaneously: + Directly involved in the production of products. + Determine the total quantity and volume of products produced according to fixed asset capacity. + Actual average monthly capacity in the fiscal year is at least 100% of fixed asset capacity. |

Calculating depreciation of fixed assets

Straight-line depreciation method

Formula:

Monthly average rate of depreciation equal to the yearly depreciation divided by 12 months.

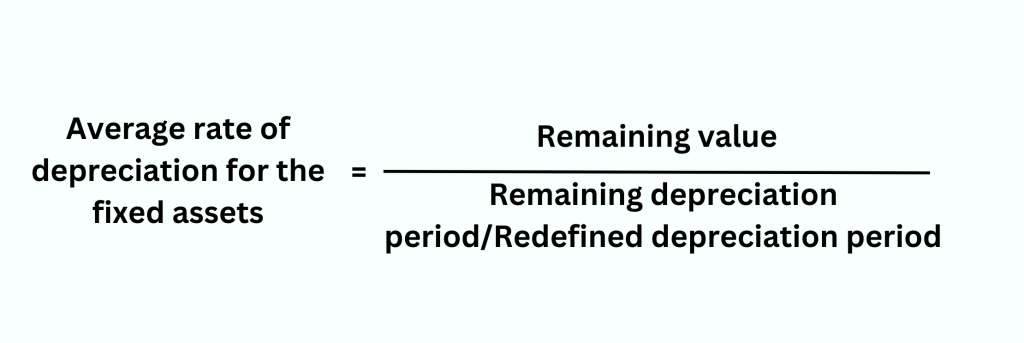

Special case: Change of depreciation period or change of historical cost:

Example 1: Depreciation of fixed assets using the straight-line method

On March 10, 2023, company C purchased a photocopier with the price of VND 73,000,000 (excluding VAT), the delivery cost was VND 2,000,000. It was purchased and used immediately. The company registers to depreciate using the straight-line method.

- Determining the period of depreciation: Following the above “Time frame for depreciation of fixed assets” table, copiers have a useful life of 7 – 15 years. So the company chooses to depreciate within 10 years (You can consider how often the machine is used, the cost structure as well as the revenue generated to choose the appropriate number of years but ensure it is within depreciation framework prescribed by the Ministry of Finance).

- Historical cost of fixed assets = Purchase price of fixed assets + Costs of putting fixed assets into use (transportation, installation, etc.) = 73,000,000 + 2,000,000 = VND75,000,000.

- Annual depreciation: 75,000,000/10 = VND7,500,000.

Example 2: Fixed assets have a change in depreciation period and historical cost

Company D purchased a fixed asset on April 10, 2016 with the price of VND120,000,000 (excluding VAT). Company D got a trade discount of VND 8,000,000, delivery cost of VND3,000,000, and the cost of testing fixed assets was VND 2,000,000. The company registers to depreciate using the straight-line method, the depreciation period is 10 years.

- Historical cost of fixed assets: 120,000,000 – 8,000,000 + 3,000,000 + 2,000,000 = VND117,000,000.

- Annual depreciation: 117,000,000/ 10 = VND11,700,000/year.

However, after 4 years of use, the company wanted fixed assets to reach a larger capacity, so they upgraded fixed assets with a total cost of VND 25,000,000. On April 10, 2020 completed the upgrade and put into use and re-evaluated the useful life to increase to 7 years compared to the original (additional 2 years).

The depreciation period is also increased to 7 years respectively. Depreciation rate of fixed assets after upgrading:

- Original cost of fixed assets after upgrading: 117,000,000 + 25,000,000 = VND142,000,000.

- Accumulated depreciation: VND11,700,000 x 4 years = VND 46,800,000.

- Residual value of fixed assets: 142,000,000 – 46,800,000 = VND 95,200,000.

- Annual depreciation (from year 5 toward): 95,200,000/7 = 13,600,000 VND.

Note: Only the cost of upgrading fixed assets can be added to the historical cost of fixed assets, repair costs (without increasing capacity, life of fixed assets) are not recorded in the historical cost but only recognized as expense incurred during the period.

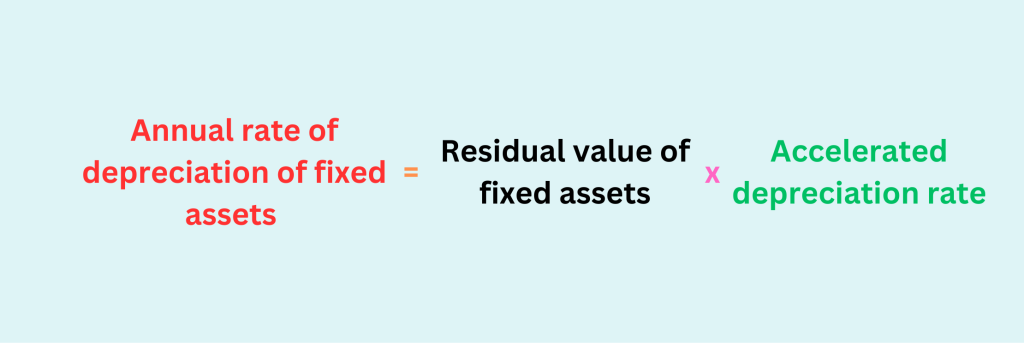

Adjusted reducing balance method

Formula:

In which:

| Accelerated depreciation rate (%) | = | Rate of depreciation by straight-line method | X | Adjustment coefficient |

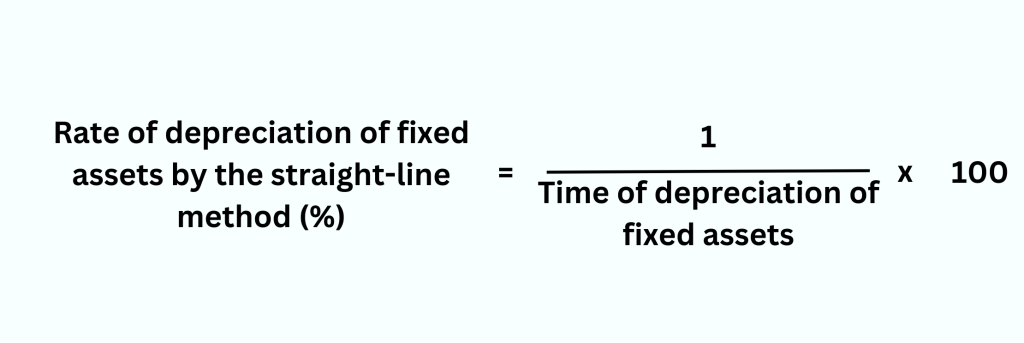

Rate of depreciation of fixed assets by the straight-line method is determined as follows:

The monthly rate of depreciation is equal to the yearly deducted depreciation divided by 12 months.

Adjsutment coefficient is determined by the time of depreciation of fixed assets specified in the following table:

| Time of depreciation of fixed assets | Adjsutment coefficient (time) |

| Up to 4 years | 1,5 |

| Over 4 years | 2,0 |

For the last years, when the annual rate of depreciation determined by the reducing balance method above mentioned is equal to ( or lower) the average rate of depreciation between the Residual value and remaining number of years of utilization of fixed assets, then from that year, the rate of depreciation is calculated by the Residual value of the fixed assets divided by the remaining number of years of utilization of fixed assets.

Example 3: Depreciation to an adjusted declining balance

Company F purchased measuring equipment at the original price of VND 50,000,000. The useful life of this asset is 6 years.

The depreciation rate of this fixed asset is determined as follows:

• Depreciation rate using the straight-line method: (1/6) x 100 = 17%

• Rapid depreciation rate (more than 4 years): 17% x 2 = 34%

• Depreciation rate over the years:

Unit: VND

| Year | Residual value | Depreciation |

| 1 | 50,000,000 | 50,000,000 x 34% = 17,000,000 |

| 2 | 33,000,000 | 33,000,000 x 34% = 11,220,000 |

| 3 | 21,780,000 | 21,780,000 x 34% = 7,405,200 |

| 4 | 14,374,800 | 14,374,800 x 34% = 4,887,432 |

| 5 | 9,487,368 | 9,487,368/ 2 = 4,743,684 (*) |

| 6 | 9,487,368 | 9,487,368/2 = 4,743,684 |

(*) From the 5th year, the depreciation if calculated by adjusted declining balance method is: 9,487,368 x 34% = VND3,225,705 which is less than the residual value divided by the number of years of use 9,487,368/2 = VND4,743,684, so from the 5th year, the depreciation rate is VND4,743,684/year.

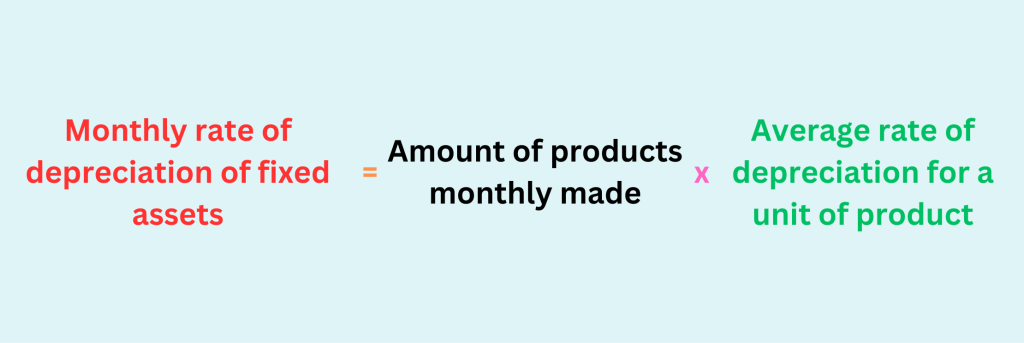

Method of depreciation based on volume

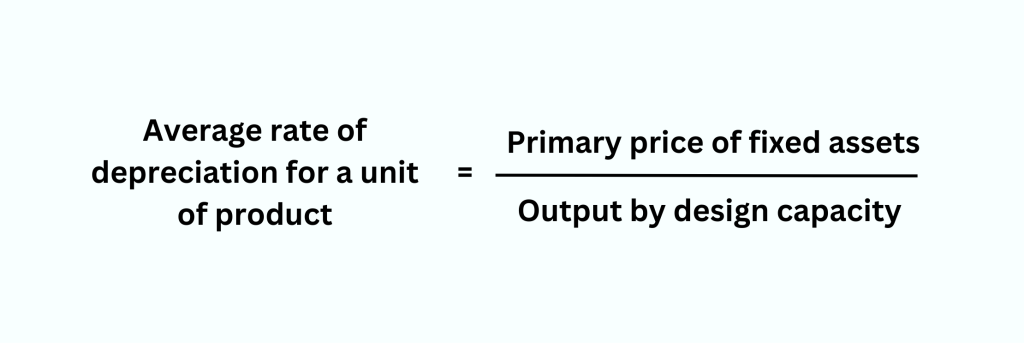

Formula:

In which:

Example 4: Depreciation based on volume

On March 10, 2022, Company C, operating in the printing industry, purchased a photocopier at VND 35,000,000. The machine was bought and used that day. The capacity of this copier is 30,000 sheets/year. The output achieved in 2022 is 12,000 sheets.

The depreciation for 2022 is:

• Average depreciation for 1 product unit: 35,000,000/30,000 = VND 1,167/sheet.

• Annual depreciation: 12,000 x 1,167 = VND 14,004,000

The method of depreciation of fixed assets required to notify the tax authority?

According to the provisions of Clause 3, Article 13, Circular No. 45/2013/TT-BTC, after selecting the appropriate method of depreciation of fixed assets, the enterprise must notify the tax authority directly managing it in advance when starting to apply.

This Notice is included with the Initial Tax Declaration dossiers.

Refer to INNO’s Initial Tax Declaration services

It possible to change the depreciation method during the period of use?

– According to Clause 4, Article 13, Circular No. 45/2013/TT-BTC Depreciation method applied to each fixed asset the company has selected and notified to the tax agency directly managing must be implemented throughout the fixed asset’s life.

– In exceptional cases where it is necessary to change the depreciation method, the enterprise must clearly explain the change in using fixed assets to bring economic benefits to the enterprise. Each fixed asset is only allowed to change the depreciation method once during its use and must notify the tax authority directly managing it in writing.

Dossier of notification of the change in depreciation method of fixed assets:

+ Power of attorney (if the applicant is not a legal representative).

+ Notice of change of method of depreciation of fixed assets.

Can depreciate fixed-asset differently from the depreciation time frame of the Ministry of Finance?

Yes. Companies are allowed to depreciate differently than the depreciation time frame prescribed by the Ministry of Finance, but companies must explain the reasons, including:

- Technical life of fixed assets according to design.

- Current status of fixed assets (new, used, etc.,).

- Impacts from the increase or decrease in depreciation of fixed assets on business results and sources of capital to repay credit institutions

- For fixed assets formed from investment projects in the form of B.O.T, B.C.C, the contract signed with the investor is added.

Where to apply:

- For the parent company of economic groups; Corporations; State-owned companies hold 51% of the charter capital established by ministries, sectors, and the Prime Minister; subsidiaries owned by the parent company Economic Group; Corporations holding 51% or more of charter capital shall submit them to the Ministry of Finance.

- or the Corporation, independent companies established by the People’s Committees of provinces and centrally run cities; Enterprises of other economic sectors headquartered in the locality shall submit their documents to the Department of Finance.

Dossier:

• Power of attorney (if the applicant is not a legal representative)

• Plan to change the time of depreciation of fixed assets

• Notice of change in the depreciation period

Can an enterprise change the time of depreciation of fixed assets during its operation?

The answer is Yes. However, enterprises are only allowed to change the depreciation period of fixed assets once for an asset and ensure that the extension of the depreciation period of fixed assets does not exceed the technical life of the fixed assets and does not change the business results of the enterprise from profit to loss or vice versa at the year of the decision to change.

Suppose the enterprise changes the time of depreciation of fixed assets in contravention of regulations. In that case, the Ministry of Finance and the tax agency directly managing it shall request the enterprise to re-determine it according to regulations.

Explore more

Related services

News

Related Posts