INNO Accounting services

Vietnam regulations on valid invoices, VAT calculation methods and VAT deduction instructions

Main content

Regulations on invoices and vouchers eligible for VAT deduction

Invoices and vouchers to be eligible for VAT credit must satisfy 03 conditions simultaneously:

+ Goods and services purchased must serve business activities.

+ Invoices and vouchers must be in accordance with regulations. The VAT invoices that qualify for deduction must meet the following requirements:

- Invoices in accordance with the law (registered invoices and approved by tax authorities);

- Information of the company must be accurately reflected on the invoice (company name, tax code, address);

- The invoice must correctly state the actual value of the purchased goods or services;

- Fake or forged invoices must not be used.

+ For purchased goods and services with VAT invoices (including imported goods) worth over VND 20 million, there must be non-cash payment documents as follows:

- Payment made through banks by payment methods such as checks, power of attorney for collection, power of attorney for payment, bank cards, credit cards, e-wallets, and other methods as specified by regulations.

- Other non-cash payments made through the following methods: offsetting the value of goods or services, offsetting debts with a third party, third-party payment authorization through banks, etc.

Note: In cases where goods or services are purchased from a supplier with a value under VND 20 million but purchased multiple times in a day with a total value of over VND 20 million, payment must be made through banks.

Methods of calculating VAT

There are three methods of calculating VAT:

VAT deduction method

VAT deduction method applies to the following businesses:

- Businesses establishment with annual revenue from sales and services of VND 1 billion or more.

- Business establishments voluntarily registered to apply the tax deduction method.

The VAT calculation formula by deduction is as follows:

For example:

INNO Accounting provides tax declaration services, subject to a 10% VAT rate. INNO’s total revenue in Q2/2023 is VND 500 million, with a VAT (output) of VND 50 million. In that quarter, INNO purchased goods and services from other companies with a total value of VND 400 million, and a VAT (input) of VND 40 million. But have an invoice INNO purchased website design service, service fee was VND 25 million, VAT 10% was VND 2.5 million INNO paid by cash so that not eligible for input VAT deduction. The creditable input VAT is just 37.5 VND million (VND 40 million – VND 2.5 million)

=> Using the formula, the amount of VAT payable can be calculated as follows: VAT Payable = Output VAT – Creditable Input VAT = VND 50 million – VND 37.5 million = VND 12.5 million.

Therefore, the total amount of VAT payable by INNO in Q2/2023 is VND 12.5 million.

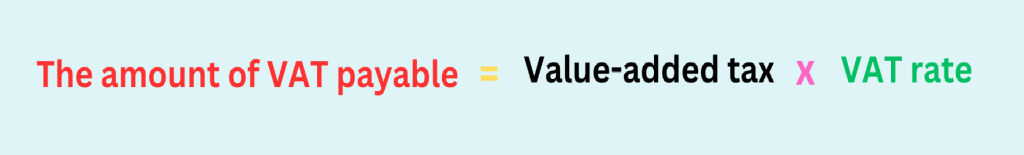

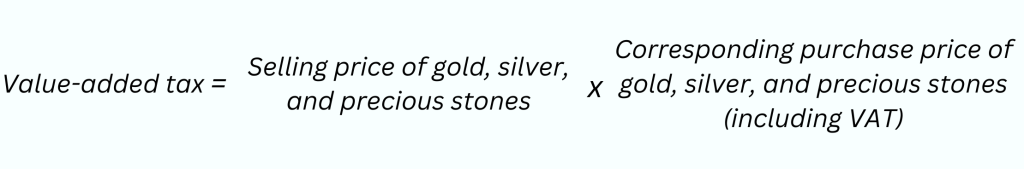

Direct on Value-Added

Applied to companies operating in purchasing, selling, processing gold, silver, and precious stones.

In which:

VAT rates for gold, silver, and precious stones:

Exempt: Imported gold bars, gold pieces, and other forms that are not crafted into jewellery or other items.

10%: For the remaining activities.

For example: Company A is engaged in the business of gold, silver, and precious stones. In Q1/2023, Enterprise A had a total of VND 100 million worth of purchases of jewellery from suppliers (price including VAT) and a total selling value of VND 150 million.

=> The amount of VAT payable = Value-added tax x VAT rate = (VND 150 million – VND 100 million) x 10% = VND 50 million x 10% = VND 5 million.

Therefore, the total amount of VAT payable by Enterprise A in Q1/2023 is VND 5 million.

Direct on Deemed Revenue

Applied to:

- Enterprises, cooperatives with annual revenue below one billion dong and not voluntarily registering to apply the deduction method.

- Individuals, business household.

- Company not fully adopt VAS.

In which:

The percentage % for VAT is determined as follows:

• Distribution and supply of goods: 1%

• Services, construction without material procurement: 5%

• Production, transportation, services related to goods, construction, and material procurement: 3%

• Other business activities: 2%

For example:

Enterprise B operates a Spa service, with a generated revenue of VND 150 million. The company must declare VAT at a 5% VAT rate on the total Spa service revenue.

=> The amount of VAT payable = Revenue x Percentage % = VND 150 million x 5% = VND 7.5 million.

Therefore, the total amount of VAT payable by Enterprise B based on its revenue is VND 7.5 million.

VAT deduction instructions

For output goods and services with different tax rates, input VAT for the business of such goods and services will or will not be deducted. INNO summarizes the cases in the table below:

| Type | Tax treatment | |

| Output VAT | Input VAT | |

| VAT exempt | Exempt | Non-creditable |

| Cases not require to declare out VAT | No VAT declaration | Creditable |

| Subject to 0% VAT rate | 0% VAT | Creditable |

| Subject to 5% VAT rate | 5% VAT | Creditable |

| Subject to 10% VAT rate | 10% VAT | Creditable |

Explore more

Related services

News

Related Posts