INNO Accounting services

Vietnam deadline for filing tax returns and penalties for late filing

Tax return filing deadline

Declaration for each time arising

The deadline for tax return file and payment (if any) is the 10th day after the tax liability arises.

For example: An individual has changed his/her identification information on April 15, 2023, the deadline for submitting a notification of change is April 25, 2023.

Monthly tax returns

The deadline for monthly tax return file and payment (if any) is the 20th of the following month.

For example: The deadline for filing Personal Income Tax (PIT) returns for May 2023 is June 20, 2023.

Quarterly declaration

The deadline for tax return file and payment (if any) is the last day of the following month.

For example: The deadline for filing Value Added Tax (VAT) returns for the second quarter of 2023 (April, May, June) is July 31, 2023.

Annual declaration

The deadline for tax return file and payment (if any) is the last day of the third month from the end of the calendar year or fiscal year.

For example: The deadline for filing an enterprise’s corporate income tax return (CIT) 2022 is March 31, 2023, if the company applies the calendar year (01/01 – 31/12) tax period.

Note: For CIT, companies must temporarily calculate quarterly profit/loss and fully pay at least 80% CIT arising of the year (if any) before January 31 following the year (profit/loss calculation and payment tax only, no quarterly CIT return file needed)

In case the deadline for submitting tax returns and paying taxes falls on a holiday, the deadline for submitting tax returns is the next working day.

Penalty for late filing of tax returns

Unit: VND

| NUMBER OF DAYS LATE | FINES |

| Late from 01 to 05 days, there are extenuating circumstances (such as the first time late or having objective reasons – this case needs to be explained and accepted by the tax authority) | Warming |

| Late from 01 to 30 days (unless there are extenuating circumstances) | 2,000,000 to 5,000,000 |

| Late from 31 to 60 days | 5,000,000 to 8,000,000 |

| Late from 61 to 90 days | 8,000,000 to 15,000,000. |

| 91 days or more late but no tax payable | |

| Do not file tax returns but do not tax payable | |

| Failing to submit appendices according to regulations on tax administration for companies having related-party transactions together with the CIT finalization return.“Read more: Related-party” | |

| More than 90 days late, there is a payable tax amount, and the taxpayer has fully paid tax, and late payment interest (0.03%/day) before the tax authority announces a tax inspection (by written document) or before the tax authority makes a record of late submission of tax returns | 15,000,000 to – 25,000,000 |

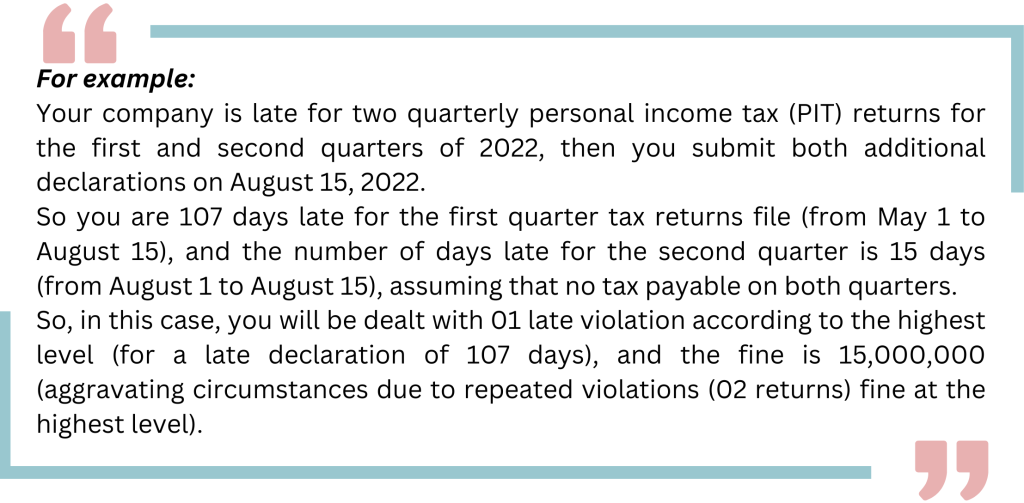

Note: The penalty for late tax return files is applied according to the violation, not the number of returns late (same tax).

Important note!!!: You must submit two additional returns on the same day. If submitted within 2 days, you will be handled with 02 violations for two returns.

Contact INNO immediately for assistance submitting additional tax returns and working with tax authorities to optimize the fine!

“Use INNO’s accounting service” to ensure your company’s accounting and tax work is timely handled, tracked, and completed!

Explore more

Related services

News

Related Posts