INNO Accounting services

Vietnam deductible and non-deductible expenses when calculating CIT

Main content

Definition of deductible and non-deductible expenses when calculating CIT

- Expenses that are deductible when calculating CIT: These are expenses serve business activities and have sufficient documents and invoices in accordance with regulations.

- Expenses that are not deductible when calculating CIT: These are expenses in production and business activities that are not eligible for deduction when calculating CIT.

Conditions for an expense to be counted as a deductible expense when calculating CIT

An expense to be counted as a deductible expense must simultaneously satisfy 3 conditions:

- Expense serve for business activities.

- Expenses with full invoices and documents in accordance with the provisions of law.

- Expenses with invoices for purchasing goods and services purchased each time with a value of 20 million VND or more, must have non-cash payment (bank payment, offsetting the value of goods, debts, authorized payment via 3rd party payment via bank).

Some special deductible and non-deductible expenses

Some expenses are specially deductible:

+ Goods/assets lost due to natural disasters, epidemics, fires are not compensated. Companies note to prepare a full set of documents:

- Send a written presentation of the damaged goods and asset to the tax office (deadline submit for Tax Office is 31st March of the following year).

- Record of inventory of damaged goods and properties.

- Written certification of the occurrence of natural disasters, epidemics or fires, issued by the People’s Committees of communes and wards, the Management Boards of the industrial and export processing zones.

- Records of the insurance agency’s acceptance of compensation (if any).

- Dossiers specifying responsibilities of organizations and individuals to be compensated (if any).

+ Goods damaged due to expiration, changes in natural biochemical processes that are not compensated are deducted when calculating tax. Enterprises note to prepare a full set of documents:

- A written explanation of the reason for damaged goods sent to the tax office (deadline submit for Tax Office is 31st March of the following year).

- Record of inventory of damaged goods.

- Claims accepted by insurance (if any).

- Dossiers specifying responsibilities of organizations and individuals to be compensated (if any).

Note: The uncompensated value of Goods/Assets/Inventories= Total value of damaged Goods/Assets/Inventories – Company value compensated by insurance agencies, other individuals and organizations.

+ Depreciation expense for fixed assets serving employees.

+ Depreciation expense for finance lease fixed assets.

+ Depreciation expenses for buildings on land such as offices, factories, and shops for business and production purposes.

+ Land use rights, if they have all invoices, comply with the law and participate in business and production activities, they will be allocated expenses each year according to the term of the use permit.

+ Expenses for clothes/uniforms in kind or in cash for staff (if in cash must not exceed 5 million VND/person/year).

+ Transportation expenses, accommodation rent, business trip for staff must have full invoices and documents in accordance with regulations.

+ Expenditures for female staff include: Job retraining if the old occupation is no longer suitable, additional medical examination expenses during the year, post-natal training, and overtime allowance.

+ Expenses for ethnic minority workers are as follows: Tuition fees (if any), housing support, and insurance in case the state has not yet supported them as prescribed.

+ Deductions for voluntary retirement fund, social security fund, voluntary retirement insurance, and life insurance for employees must not exceed the prescribed limit.

+ Expenses for repair of fixed assets, if the contract stipulates that the lessee repair during the lease period, it shall be allocated to expenses and must not exceed 3 years.

+ Expenses of non-fixed assets such as patents, technical documents, rights to use trademarks, etc. shall be allocated to business expenses and must not exceed 3 years.

+ Exchange rate difference at the time of debt collection and loan recovery with the exchange rate at the time of recognition.

+ Expenses for purchasing goods and services without invoices but with a purchase statement, form 01/TNDN, enclosed with payment documents.

Download Form 01/TNDN – Here

Read more: Goods and services eligible to make a list 01/TNDN

+ Capital construction investment expenses in the process of forming fixed assets are eligible as prescribed.

Some expenses are not deductible:

- Depreciation expense of assets not serving production and business activities

- Depreciation expense for assets without sufficient proof of ownership.

- Depreciation in excess of the prescribed amount.

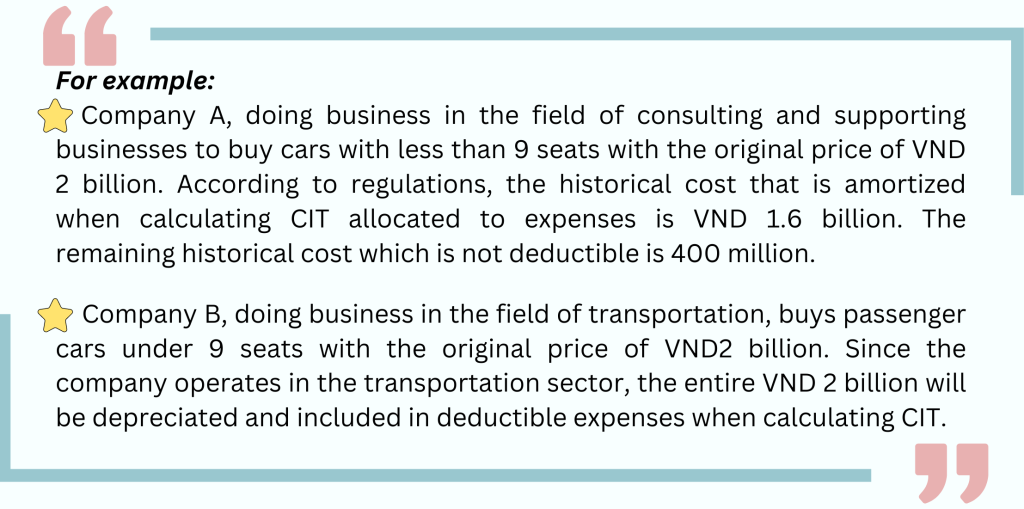

- The deduction corresponding to the original cost in excess of 1.6 billion for cars with 9 seats

or less (except for the case: used for passenger transport business, tourism business, and

hotels; cars used for modelling and test driving for the auto business).

+ Depreciation part for assets whose depreciable value has been expired.

+ Expenses for raw materials, energy and goods in excess of prescribed levels.

+ Expenses for purchasing goods and services (without an invoice, a list of purchases made

according to form No. 01/TNDN) but without 01/TNDN form and payment documents.

+ Paying salaries, wages and allowances already accounted into business and production

expenses but not paying or having no documents (payroll, payslip, etc.).

+ Wages and bonuses are not specified in terms of conditions and benefits in: labour

contracts, labour agreements, financial regulations of the company,etc.

+ Expenses of salaries and allowances paid to employees but the deadline for submitting the

annual tax finalization dossier has not been paid (the deadline for submitting the annual tax

finalization is March 31 of the following year).

+ The cost of clothing/uniform for staff in kind without invoices or in cash 5 million

VND/person/ year).

+ Grants for inventions and improvements are not specified in the regulations.

+ Expenditure on working allowances for employees in excess of the prescribed limit (for

business trip expenses must have full invoices and related documents, in case the company

provides working allowances according to a fixed amount, it is necessary to clearly specify

the level of the amount in the internal regulations/labour contract, the amount spent in excess

of the prescribed fixed amount is an non-deductible when calculating CIT).

+ Paying unemployment benefits to employees in excess of the prescribed level.

+ Electricity and water bills without a list 02/TNDN with payment vouchers for enterprises

renting production and business locations.

+ Expenses for renting fixed assets in excess of the allocation according to the number of

years that the lessee pays in advance.

+ Paying interest on loans that are not finance institutions (i.e bank, finance company) or

interest rates exceeding 150% of the basic interest rate.

+ Interest on loans corresponding to the part of the charter capital that has not been fully

contributed according to the capital contribution schedule stated in the charter of the

company.

+ Provisions are not in accordance with regulations of the Ministry of Finance.

+ Expenditures on education, health care, and disaster recovery are not in accordance with

regulations.

+ Expenses for local support, social organizations, charity expenses except for expenses for

health care, education, disaster recovery, etc are not in accordance with regulations.

+ Fines for administrative violations.

Explore more

Related services

News

Related Posts